The first of its kind, this summit focused on operational viability for NDIS providers. It brought in expert speakers, and the day was devoted to exploring and discussing how and why efficient operations must be run to support the delivery of NDIS care while remaining viable.

The Summit underscored the harsh realities faced by NDIS providers, including tight profit margins, unrealistic cost assumptions, and challenging operating conditions. However, it also highlighted opportunities to reduce inefficiencies—an essential step for any provider aiming for long-term sustainability. With an unofficial timeline of at least two years before transitioning to foundational and navigator supports, the message was clear: providers must remain agile, streamlined, and deeply familiar with their customers and operations to stay competitive.

Data from the Ability Roundtable Financial and Workforce Benchmarking set the tone for the discussion. In 2023, over half of NDIS providers operated at a loss, and 75% reported profits of less than 2%, emphasising the urgent need to reassess cost models. Key cost and profit factors include rising workers’ compensation premiums, optimising billable time (utilisation), maintaining an effective ratio of full-time staff, and achieving a balanced expenditure in supported independent living (SIL) services.

Ongoing change and reform

- Change and reform will be a constant in the NDIS industry as the NDIA continues to reduce plan values over time. This places sustained pressure on providers to deliver care more efficiently.

- Recent reforms include a heightened focus on *change of circumstances*, stricter scrutiny on what is deemed *reasonable and necessary*, and a greater need for robust evidence to justify supports.

Operational efficiency is critical

- Providers must design lean, highly transactional operations that allow for detailed visibility through data, metrics, and reporting.

- Efficient operations require robust systems to manage complexity and remain adaptable to industry reforms.

Labour productivity and cost management

- Labour remains the greatest cost for NDIS providers. To ensure viability:

- Focus on productivity and utilisation to maximise billable time.

- Keep operating costs below the Disability Support Worker Cost Model (DSWCM) levels prescribed by the NDIS scheme.

- Providers achieving higher productivity often rely on effective workforce management systems and training.

Lean practice management

- Profitable providers spend less on “area management” by adopting lean management principles.

- Minimising unnecessary management layers enhances efficiency and reduces operational drag.

Size doesn’t guarantee success

- Data shows that being bigger doesn’t necessarily equate to being more viable.

- Smaller, well-run organisations with strong systems often outperform larger, less efficient providers.

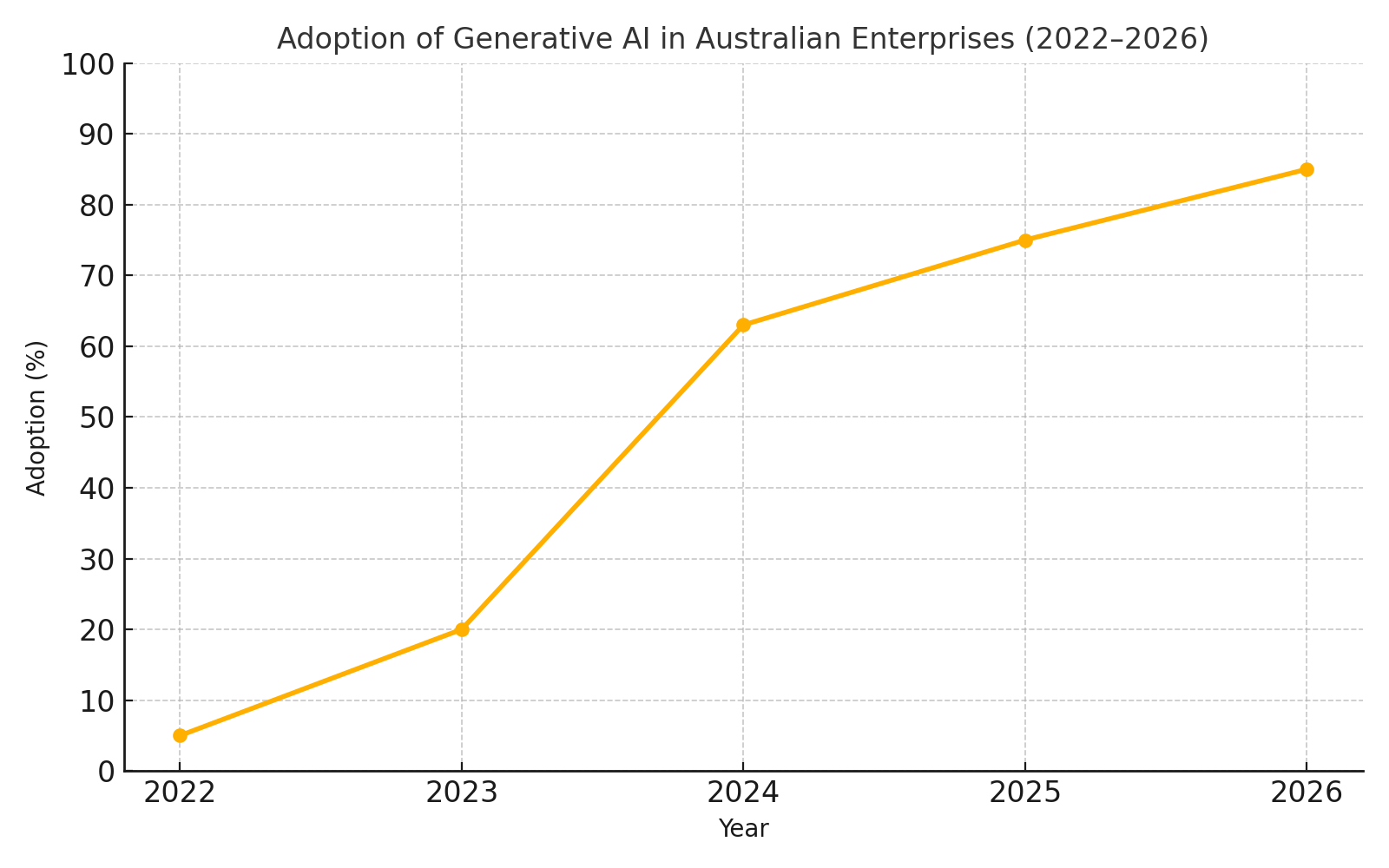

Strategic IT Investment

- Providers that invest more in IT tend to be more profitable.

- Successful implementation through robust change management and process alignment.

- Using data and analytics to drive informed decision-making.

- Leveraging AI for scheduling, resource allocation, and service delivery optimisation.

Compliance as a priority

- Compliance systems are essential to reducing costs associated with non-compliance.

- Proactive compliance measures help providers navigate the complex regulatory environment and avoid penalties.

Reacting quickly to problems

- Efficient problem resolution is critical.

- Reducing layers of management and shortening the distance between action and responsibility enables faster reactions and mitigates costs associated with operational errors.

- Short feedback loops help to foster a culture of accountability and responsiveness.

Empowering self-governing teams

- Empowering self-governing teams ensures long-term sustainability for NDIS providers.

- Teams with autonomy and accountability can adapt faster to changes, innovate in service delivery, and maintain client satisfaction.

Collaboration and advocacy matter

- Successful providers engage in sector-wide collaboration and advocacy to shape reforms and share best practices.

- Building networks and participating in summits like this one strengthens industry-wide resilience.

Adapting to funding and market trends

- Providers need to anticipate trends such as evolving participant needs, changes in funding allocation, and greater emphasis on participant outcomes.

- Emphasizing participant satisfaction and tailored support services improves retention and growth.